Creating First Contracts

Contracts represent applications and insurance policies purchased by the clients and capture all necessary details about the insurance products, including their status, change history, premium, and commission payments.

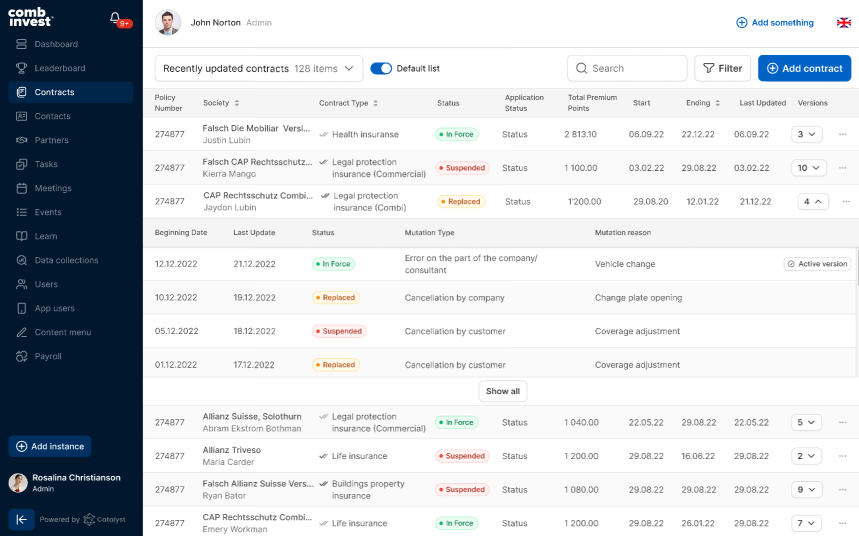

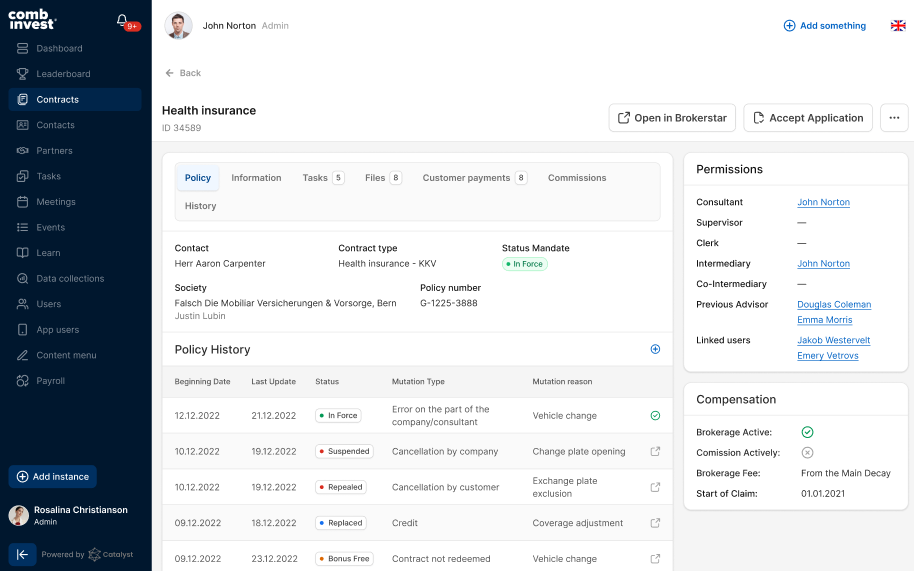

The ‘Contracts’ feature consists of two key elements, the ‘All Contracts’ table and the ‘Contract Details’ view. The ‘All Contracts’ table, as the name suggests, displays the full list of contracts, and offers the search and filtering functionality, enabling users to quickly find necessary insurance policies, or create custom lists, to have the most important contracts at their fingertips. The ‘Contract Details’ view provides instant access to the premiums, customer payments, and commissions associated with each policy. It allows users to easily identify all employees responsible for policy management and customer support (refer to the ‘User Groups’ section for more information).

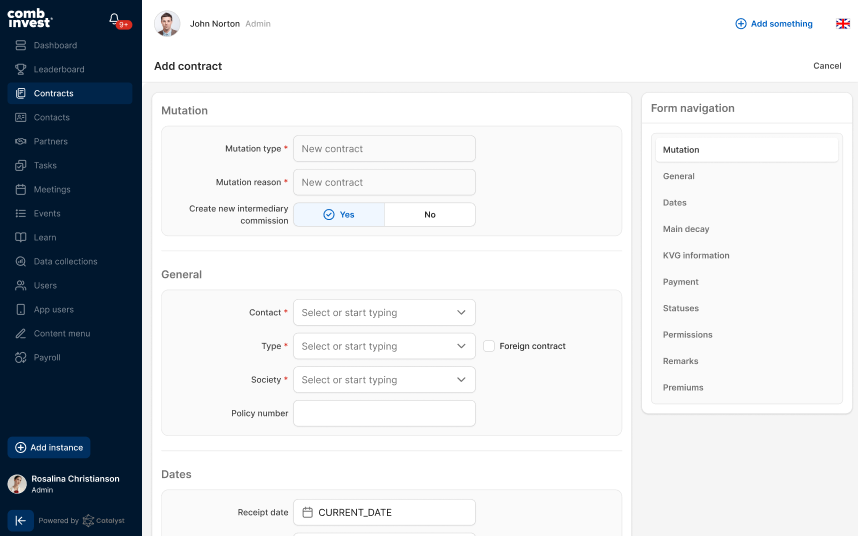

Contract creation workflow:

Select "Contracts" from the left-side menu

On the "Contracts" list view, click on the "Add Contract" button on the right side of the screen

Fill in all the information for the contract

Click Save

Important information (Glossary):

New contract - this option is used when a new contract is created.

Vehicles - will be revised by the Back Office team and most likely removed from the list.

Premium increase - is a change in the amount of a premium payment that can be initiated either by the insurance company or by the client.

Premium reduction - is a change in the amount of a premium payment initiated by the client.

Additional payment - is a payment that is added to the annuity products (’Linked Savings Plan’). A consultant (broker) earns a commission when a client selects the ‘Additional Payment’ option and makes the respective payment.

Premium break (Premium lapse) - is the removal or expiration of a policy coverage. A premium lapse occurs when a policyholder fails to make the required premium payments or decides to put on hold the payment of premiums, leading to the temporary suspension of the insurance policy or permanent termination if the premium payments are not resumed.

Partial cancellation - is used for the annuities (‘Linked Savings Plan’ policies). It is applied when a client decides to reduce the amount of regular payments to the pension plan while retaining the policy and keeping the rest of the conditions unchanged.

Partial credit - is usually applied to health insurance policies when the client cancels some of the supplementary premiums while keeping the basic coverage.

Contract not redeemed (Voided) - is used for the obligatory auto insurance policies and is set when the application has been created and approved but the client failed to complete the car purchase or make any premium payment.

Credit - is applied to contracts that get cancelled and renewed. This option can be applied to contracts that get cancelled by mistake, for instance when miscommunication occurs between the client, the insurance company, and the consultant.

Cancellation by customer - is set when clients initiate the cancellation of a policy. This may happen for several reasons, such as budget constraints, better coverage options offered by other providers, or when clients consider the terms and conditions of a policy inflexible and unfavorable.

Cancellation by company - is set when insurance companies initiate the cancellation of a policy. Insurance companies do so when they want to avoid being stuck in a contract with a client who has become uninsurable.

Error on the part of the company/consultant - is set when an error is discovered in the policy. Such errors may include a failure to collect or provide complete and accurate information about the client’s needs, risks, or existing coverage; errors in data entry, such as incorrect information about the property, business operations, or personal details; poor communication with insurance carriers or a failure to keep the client and policy information up to date; a client’s or broker’s failure to disclose material facts that are crucial for underwriting.

Change of address - is set when a client moves to another region (canton in Switzerland) within a state. For instance, in Switzerland, health insurance providers can set different premiums for the same type of insurance coverage depending on a canton, or even a certain region within a canton. Thus, every time a policyholder changes their place of residence and moves to a location where premium levels differ, a respective change must be reflected in the policy.

New in mandate - is set when a client decides to transfer a foreign contract (a contract that has been concluded earlier, without the mediation of the Combinvest brokers) to their current consultant.

Nationality change - is set when a policyholder obtains another citizenship or renounces their current citizenship in favor of another citizenship. In Switzerland, insurance policies - particularly those related to health, life, and certain types of property insurance - often have specific requirements regarding the policyholder's citizenship and residency status.

Generate a new Intermediary commission - The new intermediary commission is set when the policyholder decides to increase or decrease premiums for a certain coverage area, and the contract must be mutated.

Contact - this field identifies a client who can be either at the ‘Lead’ or ‘Customer’ stage. In Catalyst, the client at the ‘Lead’ stage is automatically promoted to the ‘Customer’ stage when the first application is accepted by a consultant (by clicking on the ’Accept Application’ button for a respective contract). Once this action is performed, the application with ‘Accepted’ status turns into a contract with the ‘In Force’ status.

Type - a type of an insurance contract (policy).

Foreign Contract - refers to a contract that was concluded with a client without the mediation of brokers. This category encompasses all contracts a given person had prior to becoming a company's client.

Society - an insurance company that provides coverage.

Policy Number - a unique identifier generated on the partner insurance portal for an application when a consultant generates a quote (offer) for a client. This number can be found in the PDF copies of insurance policies and is entered manually in the respective field when a contract is created in Catalyst.

Closing Date - the date of the second face-to-face meeting when the offer is signed by the client.

Receipt Date - the date when a back-office employee receives an approved contract from the consultant.

Beginning Date (Policy Start Date) - is the day when coverage under an insurance policy begins. This is the ‘original’ policy start date that was negotiated with the client during the proposal meeting. Usually, it is the same as the Acceptance Date.

Expiration Date (Policy End Date) - is the day when coverage under an insurance policy expires. This is the ‘original’ policy end date negotiated with the client during the proposal meeting. The policy may be cancelled on the client’s request or terminated prematurely by the insurance company for various reasons.

Acceptance Date - the date when an insurance company accepts (approves) the offer. Usually, it takes 2 or 3 weeks for the underwriters to review the offer, perform an analysis, and assess risks before a decision is made to accept or reject the offer and issue a policy to a client.

Main Decay (Last Coverage Date) - The last day of coverage after the policy cancellation date. Usually, this is the same date as the policy end date or the day immediately following this date. It is the last date when a policyholder can file a claim and get reimbursed by the insurance company. This is the ‘original’ last date of coverage that was negotiated with the client during the proposal meeting.

Period of Notice (Nonrenewal or Cancellation Notice) - Most of the insurance policies (unless it’s a ‘Life Insurance’ type of product) are concluded for one year. At the end of this term, the policy is automatically renewed by the insurance provider unless the company decides to cancel the policy due to fraudulent claims, non-payment of premiums, increased coverage risk, or other reasons. The cancellation (nonrenewal) can be initiated by the policyholder as well. When the insured does not wish to renew coverage, a written notice must be sent to the insurance company within a specified period before the policy end date. The written notice must include reason(s) for the nonrenewal of the policy.

Terminable Off (Requested Termination Date) - is the new coverage end date, requested by the client in a cancellation or nonrenewal letter.

Terminated by (Requested Last Coverage Date) - is the new last coverage date, requested by the client in a cancellation or nonrenewal letter.

Contract Statuses:

Bonus Free - this status is usually applied to the ‘Linked Savings Plan’ (Private Pension Plan) contracts. Under this condition, the policyholder will no longer have to pay premiums while retaining the contract. The insured will not be able to withdraw money from the plan. The insurance company will manage these assets for the rest of the policy term. However, under the ‘Bonus Free’ option the plan will essentially be turned into a deposit account, and when the policy expires, the policyholder will be able to withdraw all the funds that have been invested plus the interest.

Quit (Early Termination) - this status is usually applied to mandates when the policyholder files a cancellation request and asks for a new termination date. This status means that the mandate will be valid (active) for the remaining period, however, it will expire earlier than the original end date that was negotiated with the client. Once the mandate expires, its status is set to ‘Annulled’.

Netted - this is a very specific financial term rather than a status that can be applied to most of the insurance products, and it will likely be removed from the list.

Annulled (Voided) - is set for the policy cancelled by the insurance company if the client has failed to pay a single premium or submitted a cancellation letter within 14 days of the policy adoption date. In both cases, no coverage is provided, and the policy is considered void as if it never existed. This contract status is usually paired with the ‘Application Withdrawn’ or ‘Policy Revoked’ request statuses. The ‘Annulled’ contract status means that the Intermediary Commission payment hasn’t been paid to the consultant.

Application - this status is set for all offers before they get approved (adopted) by the insurance companies. This contract status is always paired with one of the respective application request statuses (for example, Contract Status: ‘Application’ and Request Status: ‘Application Submitted’).

Cancelled - is set when an insurance policy is canceled for non-payment of premiums required by its due date after the client has made at least one premium payment.

Unknown - this status is not and will likely be removed from the list. The Back Office employee should not apply this status to a contract. When a status is unknown, the Back Office must reach out to the consultant and clarify it.

Premium Break (Lapse) - is usually applied to the ‘Linked Saving Plan’ type of product when a client decides to put the premium payment on hold while retaining the contract. The coverage is paused for the period of time defined by the client and is reinstated when the client resumes premium payments. When the client resumes the payment of premiums, the coverage is reactivated without premium increases or any other penalties. When the ‘Premium Break’ status is set for a contract, all request statuses should be removed.

Cancellation Sent - is usually used for the mandates. This status is rarely used now. This status is set when a client submits a cancellation letter to the insurance company with the requested end date on which the coverage will expire. When the ‘Cancellation Sent’ contract status is selected, the request status shall remain at the ‘Application Adopted’ status.

Request Status (Application Status):

Application Submitted - is set for the applications that have just been submitted for review to the underwriters.

Application Adopted - is set for the applications that have been approved by underwriters.

Application Rejected - is set for the applications that have been rejected by underwriters. The rejection can be caused by several reasons, for instance, the applicant’s risk factors are deemed too high, a client has a poor credit history, a history of frequent or severe insurance claims, a client provided fraudulent data in the application, etc.

Application Withdrawn - is set when a client decides to cancel the policy within 14 days after it was approved by the insurance company and before the first premium was paid.

Application Back To CA (Application Awaiting Completion) - is set when the underwriter finds that the information provided in the quote (offer) about the client is insufficient and requests additional data from the consultant.

Policy Revoked - is set for a contract when the client fails to make the premium payment after its due date and after the grace period expires.

The Mandate (Covered by the Broker of Record Letter) - is set when a given contract is managed under the Broker of Record Letter.

Not In The Mandate (Not Covered by the Broker of Record Letter) - is set when a given contract is not managed under the Broker of Record Letter.

Empty Field - is set when the exact status of the broker-of-record relationship hasn’t been established yet or is unknown at the moment.

Mandate (Broker of Record Letter) - a Broker of Record Letter (German: ‘Mandat’) is a legal document that authorizes the broker to represent the client in purchasing, maintaining, and servicing an insurance policy. In the Catalyst context, a BoR Letter is signed when a consultant chooses the ‘Brokerage’ over the ‘Commission’ payment option.

Yearly Termination Right - this status is set for policies that allow the client to cancel coverage annually without hefty penalties imposed on premium refunds.

Brokerage or ’Ongoing Commission’ (German: ‘Courtage’) - continuous payments paid to the broker by an insurance company at regular intervals throughout the life span of the insurance policy. When a broker selects the brokerage option, the client and the consultant sign a Broker of Record Letter (German: ‘Mandat’). Under the brokerage option, the broker will receive regular brokerage payments on earned premiums (premiums that have been paid by the policyholder to the insurance company).

Commission or ’Single Commission’ (German: ‘Provision’) - a single lump-sum payment paid to the broker by the insurance company shortly after the sale is completed. When a broker selects the commission option, no Broker of Record Letter is signed between the client and the consultant, and the policyholder is solely responsible for negotiating with the insurance company, managing his/her existing policies, filing claims, etc. The consultant gets a one-time commission from the insurance company as a reward for bringing in a new client, but no further commission payments will be paid to the broker for the premiums paid by the client.

Remarks - any note that a Back Office employee can make while creating the contract, or a Sales Force/Sales Lead can add to the existing contract.

Premium:

Request Status - the request status in the premium context refers not to the application status of a certain premium. Policies offered by insurance companies can include several, even up to a dozen specific products.

Product - the products represent either a combination of certain coverage types, or a level of services provided under a certain product. For instance, an insurance policy can consist of dental and prescription medication coverages, in addition to the main coverage for the medical and surgical expenses of the policyholder. A separate premium is set for each product (coverage area).

Premium 100% - the full amount of the premium to be paid for a product.

Discount Net - certain insurance companies can offer a discount on their policies to attract clients. For instance, Zurich Insurance Company can offer a 30 percent discount for the first year of the 3-year auto insurance policy.

Net Premium - the total amount of the premium to be paid by the policyholder after a relevant discount has been applied. However, the Back Office employees usually enter the final (total) amount of the premium with a discount applied right in the ‘Premium 100%’ field.

Stamp duties - a percentage of the premium that must be paid to the applicable tax authority for the insurance purchase.

5% - the default amount of the stamp duty.

Special (12%) - the default value of the discount gross.

Valid from - the date when the coverage under a specific product starts.

Inactive - when an insurance contract contains several products, some of them can be deactivated while allowing the policyholder to retain the policy with the remaining products. Thus, the ‘Inactive’ status is set when a product is deactivated and the related premium will not be paid.

Brokerage Commission:

NP - net premium (Italian/Latin: ’Netto premium’)

BP - gross premium (Italian/Latin: ’Brutto premium’)

LZ - policy term or coverage period (German: ‘Laufzeit’)

LZ35 - a policy with a 35-year term. This parameter is usually applied to life insurance or private pension plans. The maximum duration of such a contract varies by company, with some insurers offering 45-year term policies.

VS - same as ‘Sum Insured’ (German: ‘Versicherungssumme’). The Sum Insured is the maximum amount that an insurer will pay if a policyholder make a claim for a covered event.

LS-AHV - compulsory Old Age and Survivors Insurance ****(German: ‘Alters- und Hinterlassenenversicherung’).

LS-UVG - compulsory Accident Insurance (German: ’Unfallversicherungs’)

LS-BVG - compulsory Occupational Retirement, Survivors' and Disability Pension Plans (German: ‘Berufliche Alters-, Hinterlassenen- und Invalidenvorsorge’).

Commission Units - as mentioned earlier, the calculation of a premium depends on a particular product type. The commission unit parameters are automatically populated by the system, based on the selected product. The parameters for the commission units are defined in the ‘Configurations’ section of the system (’Contracts’ group, ‘Products’ type).

Perils - a peril is a potential event or factor that can cause a loss, such as the possibility of a fire that could engulf a house. In insurance contracts, the perils that are covered are usually specified. In the Catalyst context, this value indicates the amount of money paid by the policyholder to be covered for the damage that can be caused by a particular event. (Fire, wind, water, and theft, are the perils that are commonly listed.)

Sum Insured - is the maximum amount that an insurer will pay if a policyholder makes a claim for a covered event.

Insured Amount Outside CH - is the amount that an insurer will pay if a policyholder makes a claim for a covered event while being outside of Switzerland.

Deductible - is the amount of money that the insured person must pay out of pocket every year before their insurance policy starts paying for covered expenses. A deductible is usually applied to health insurance policies. In the Catalyst context, a deductible is a fixed amount of money that a policyholder must pay for a covered event.

Previous Insurer - is a mandatory field to be filled out for the health insurance policies.